|

||

|

News Downloads Screen Shots High Scores How To Play Version History Support |

||

|

||

|

![]()

|

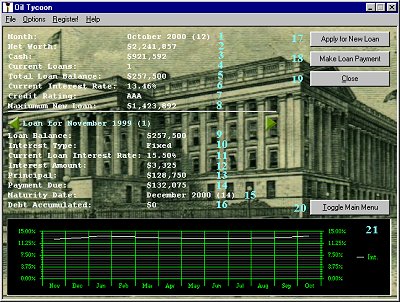

Whenever you need quick cash, you can get a loan from the bank. The bank will allow you to take out a loan of up to 75% of your net worth. It takes one month to clear your credit before the check for your loan comes in. You can choose one of two types of loans: fixed-rate and variable-rate. For a fixed-rate loan, the interest you pay stays the same throughout the entire life of the loan. For a variable-rate loan, the interest depends on the current interest rate for the month. Make sure you pay your loans on time, or your credit rating will decrease! General Information:  1. Month: The current month you are in.

You start the game on the current month according to your computer

clock. The number in parenthesis next to the month is the turn

number you are currently on. The game lasts for 120

turns. 2. Net Worth: The total net worth of all your assets, including cash, crude oil, products, land, etc., minus your debts. 3. Cash: This is the amount of cash you

currently have available to you for purchases. 4. Current Loans: The number of loans you

current have. 5. Total Loan Balance: The sum of the current balance of

all of your loans. This is the amount you owe the bank, minus any

interest. 6. Current Interest Rate: The interest rate for the current month. The interest rate follows the trend in the price of various products compared to the cost of refining. If the cost to refine crude is much less than the price the products can be sold, the interest rate is generally low. However, if the cost of refining is high compared to that of selling, the interest rate is usually high. 7. Credit Rating: Your current credit rating. You start out with the highest rating, "AAA." However, if you start to miss your loan payments, your credit rating starts to decline. You will not be able to take out a full loan if your credit rating is below "AAA." If your credit rating is "D" and you miss another payment, the bank will begin to repossess your assets. So make sure you always have enough cash at the end of the month to pay back your loans! 8. Maximum New Loan: The largest loan you can

currently take out. This factor depends on your credit rating, your

current net worth, and the amount of loan debt you have. You cannot

take out a loan that if your debts are greater than your

assets.. The follow items only appear when you currently have a loan. You can switch between loans by click the green arrow at the top of this section. 9. Loan Balance: The amount you still owe on the selected

loan, minus interest. 10. Interest Type: The type of interest for

the selected loan, either fixed or variable. The interest for a

fixed-rate loan depends on the interest rate when you applied for

the loan. The interest stays fixed at that rate plus an additional

3%. The interest for a variable-rate loan depends on the interest

rate for the current month. The interest rate for the loan rises and

falls with the current interest rate, but the interest rate is not

increased by 3% like fixed-rate loans. 11. Current Loan Interest Rate: The amount of interest you

are paying for the selected loan. This value is based on the

interest type for the loan. 12. Interest Amount: The amount of interest

you have to pay for the selected loan this turn. 13. Principal: The amount that will be paid off for the

selected loan this turn. 14. Payment Due: The total amount that has to

be paid for the selected loan this turn. This value is the sum of

the principal and the interest amount for the

loan. 15. Maturity Date: The month at which the selected loan

will be paid off. After this date, you will need to make no further

payments for the loan. 16. Debt Accumulated: The amount you owe in

addition to the principal and the interest for the loan. This value

increases every time you miss a loan payment. If you have a low

credit rating and you miss additional payments, your assets will be

repossessed in order to pay off this debt. 17. Apply for New Loan button: Click this

button to apply for a new loan. See "Applying for Loans" below for

more information. 18. Make Loan Payment button: Click this

button to make a payment on the selected loan. See "Making Loan

Payments" below for more information. 19. Close button: Closes the current screen

and returns you to the main menu. 20. Toggle Main Menu: Opens the main menu

without closing the current screen. If the main menu is

already shown, clicking this button will hide the main

menu. 21. Interest Rate graph: Shows the trend in the interest rate over the past 12 months. Applying for Loans: If your credit rating is high enough and your net worth is high compared to your debt, you can take out a loan. Below is a table that determines the maximum amount of a new loan depending on your credit rating:

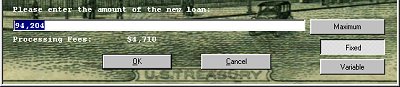

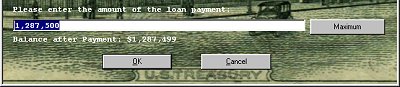

To apply for a new loan, click the Apply for new loan button. The graph at the bottom of the screen will be replaced by an area where you can specify the amount and options of the loan (shown below). The amount defaults to the maximum loan you can apply for. You can also set the amount by clicking the Maximum button. You can specify whether the loan is fixed-rate or variable rate by clicking the appropriate option buttons to the right. The processing fees required for the loan are also shown; these fees will be deducted from your cash after you click OK.  Making Loan Payments: Payments on loans are made automatically at the end of each turn. The amount is specified in the Payment Due field on the bank screen. If you do not have enough, your credit rating will decrease; if your credit rating is a D and you miss 5 additional payments, the bank will begin to repossess your assets, including crude oil, land plots, refineries, etc. Another way you can make loan payments is by clicking the Make Loan Payment button. The graph at the bottom of the screen is replaced by an area where you can specify the amount you wish to pay back on the selected loan (shown below). You can pay back as much as the entire balance of the loan if you have enough cash. After specifying the amount, click OK. The request will take 1 month to process.  |